To help you through this difficult time we want to keep you up to date with the latest government news on the support that is available. Please find a summary below:

COVID-19 Self-Employment Income Support Scheme has been extended

- Deadline for claiming under the first grant is 13/07/2020.

- The second grant is for 70% of average profits opposed to 80% in the first grant. Capped at £6,570.

- Eligibility is the same as before.

- Claims for the second grant will be from August.

- Many eligible people haven’t claimed under this scheme, so if you aren’t sure if you are eligible, get in touch to find out.

Please note that unlike the furlough scheme, you are allowed to continue working and also claim under this scheme.

Coronavirus Job Retention Scheme (CJRS) Changes

- The scheme is now in place until 31 October 2020 but with some changes.

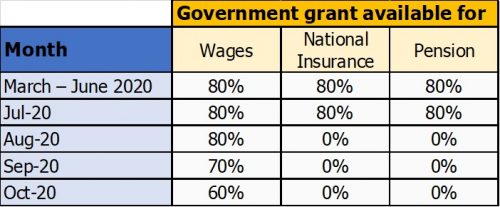

- Up until 30 June 2020 the government will cover 80% of the Wages (up to £2,500 per month), plus National Insurance and Pensions contributions for furloughed employees.

See below table showing the grant available for each month.

- Employers will still be required to pay at least 80% to the furloughed employee so employers will start to pay towards these costs in the coming months.

- Up until 30 June 2020 it was possible to claim the grant from the government at any point. A claim must now start and end in the same month.

- For example, a grant claim for 1 July 2020 to 31 July 2020 must be made on or before 31 July.

- The minimum claim period will reduce to 1 week from 1 July. This gives employers total flexibility over work rotas: all details must be agreed in writing with the employee

Find out more here: https://www.gov.uk/business-coronavirus-support-finder

If you have any questions, please do get in touch with the Modus Team, or book a free one-to-one session by calling 01993 225030. We’re here to support you.